Product number: STANLEY SM-21-51101

Product information "STANLEY SM21 - Submersible Pump"

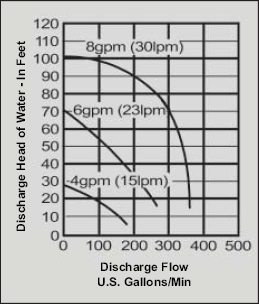

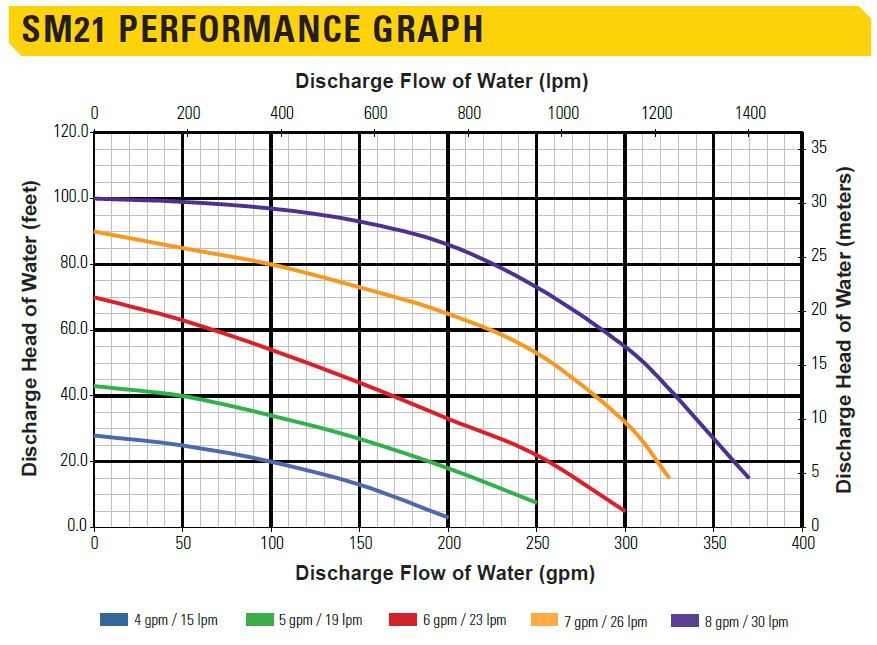

The SM21 Submersible Pump is a small diameter (caisson style) self priming hydraulic dewatering pump with a discharge flow of 300 gpm thru a 2½" NPFT discharge. At only 6¼" wide the SM21 can fit in small openings. The cast iron impeller is within ¾" of the base allowing it to remove more liquids than other pumps.

Particularly narrow pump. Ideally suited for narrow shafts.

- Water flow rate: 1,125 L / min.

- Max. Delivery head: 30 m

- Grain: 9 mm

- Hose connection: 2 ½ “NPT female

- Oil volume (inlet): 15-34 L / min. (30) @ 70-140 bar

- Impeller cast iron, go. Cast iron

- Dimensions: 406x159 mm

- Weight: 9.1 kg

Properties from "STANLEY SM21 - Submersible Pump"

| (11) Förderleistung - Tauchpumpe: | 1000 bis 2499 L/min |

|---|---|

| Drive: | Hydraulic connection, constant flow rate |

| Grain / passage: | 9 mm |

| Hose connection: | 2-1/2" NPT-IG (female) |

| Hydraulic oil flow input: | max. 34 L/min. |

| Max. oil flow output: | 1.125 L/min. |

| Max. pumping height: | 30 Meter |

| Working pressure: | max. 140 bar / 2.030 PSI |